Cryptocurrencies are entirely digital, which means you can send or receive them with a corresponding digital wallet on a computer or smartphone. Still, you might be surprised to know that cryptocurrencies are not actually “stored” in a cryptocurrency wallet, or really anywhere.

Instead, your ownership is tied to a unique key. A cryptocurrency wallet offers a friendly interface to interact with this key, either to prove ownership or spend your balance. Wallet form factors are incredibly varied these days, ranging from mobile apps to USB stick-like devices.

Intrigued? Let’s decode how cryptocurrency wallets work, and what you should look for before picking one up for yourself.

What is a cryptocurrency wallet?

For decades, banks and other institutions were the only entities that could deliver financial inclusion to the masses. Now, cryptocurrency threatens to take over this role. What’s more, its proponents claim the technology can reach more people than traditional banking services. To understand how wallets fit into all of this, we must first distill how a cryptocurrency works under the hood.

Digital currencies are often understood to be a virtual equivalent to physical coins that can be pocketed or stored in a wallet. However, this is not exactly the case. Instead, a cryptocurrency is better described as a network of digital records, or a ledger of transactions.

In other words, you don’t own coins as much as you have a balance on the global cryptocurrency ledger. Your digital wallet then simply acts as a key to this balance — similar to how a password accesses your bank account. However, wallets are for more than just authentication.

As mentioned previously, the information about your balance is stored on the network. New changes, such as incoming or outgoing transactions, are also added to this ever-growing record and then propagated to others participating in the network. This is why cryptocurrencies are often credited with pioneering decentralized ledger technology, or more commonly, blockchain technology.

Read more: What is blockchain technology?

While a wallet’s primary utility is indeed to send and receive transactions, most modern options include quality-of-life features such as backup functionality as well. We’ll take a closer look at the various types of wallets later in this article.

To quickly summarize, wallets perform the following basic functions:

- Display your cryptocurrency balance on the network.

- Offer an interface to send and receive transactions.

- Maintain a log of past transactions.

How do cryptocurrency wallets work?

Now that we know what a cryptocurrency wallet is and isn’t, let’s dig a little deeper and understand how it functions.

Cryptocurrency wallets come in a variety of shapes and sizes. A wallet may be a desktop program, mobile app, web-based app, or a dedicated hardware device.

While each wallet type has its advantages and demerits, they all largely offer the same basic functionality.

Even the simplest of wallets will display your balance front and center. Determining this figure is simple, since cryptocurrency ledgers are public and can be audited by anyone with an internet connection. Additionally, if a new incoming transaction is reported, your wallet will adjust your total balance by that amount.

Checking your balance only constitutes half the functionality of a typical wallet though. Sending crypto to other individuals and businesses is arguably more important. To that end, wallets also offer an interface that allows you to spend your crypto balance as you see fit. Simply input a destination address and amount, and the wallet will broadcast the transaction for you.

Wallets first structure your transaction in a predetermined format so the rest of the network can understand it. Then, the transaction is signed using your unique key. Finally, this signed message is broadcast to the rest of the network over your internet connection.

When other users on the network pick up your transaction broadcast, they can immediately verify its authenticity based on the signature your wallet includes. Unlike physical signatures, digital ones cannot be forged. If every detail checks out, the transaction is pooled along with dozens of others and eventually validated by the network’s consensus mechanism.

Read more: What is cryptocurrency mining?

Private keys: Your gateway to owning cryptocurrency

As mentioned previously, the only thing you need to hold and prove a cryptocurrency balance is a private key. But how do you get one and how do they work?

Put simply, a private key is a long alphanumeric sequence of characters and has its roots in public-key cryptography. This is where cryptocurrency gets its “crypto” heritage from. Here’s what a private key looks like — not very meaningful at all.

cc4d272b0def1da706956c7a8669a8b540a3504a1396e3ba60b0649eb8471c68

When you create a new wallet, the software generates a randomized private-public key combination for you. The probability of someone else getting the same private key as you is so astronomically tiny, it’s not even worth considering.

Read more: How does public key cryptography work?

A private key’s entire purpose is to encrypt sensitive information before it is shared with the world. Another key, called the public key, can then be used to decode the message.

Your private key is meant to be a secret, while the public key can be distributed openly.

Circling back to cryptocurrency wallets once again, the private key’s role is to sign outgoing messages or transactions. Since nobody else should technically have access to your private key, the network assumes that the transaction was broadcast by the original owner.

The public key, meanwhile, serves as the wallet’s receiving address. A retail store looking to accept payments in crypto, for example, might put up a QR code containing their public address. An online store may do the same and even embed the amount within the QR code.

Newegg, for example, accepts crypto payments. During checkout, you will be presented with the following QR code. Simply scan it with any cryptocurrency wallet to complete the transaction within a few taps.

Let’s now look at private and public keys from a practical perspective. The following screenshot shows a Bitcoin public and private key combination, generated via a web application. Don’t worry, there’s no actual balance on this wallet.

As is evident by now, creating a crypto wallet takes practically no effort, money, or time. You don’t even need an internet connection since the wallet generation code can reside on your computer.

In fact, generating your private key offline is recommended since it prevents malware or malicious actors from eavesdropping and copying it. This is also why hardware wallets are considered more secure than software-based options — they are always physically isolated from any form of network communication.

Cryptocurrency balances are permanent, whether the recipient is connected to the internet or not. For proof of this, take a look at this wallet from January 2009. Even though it owns over 68 BTC (worth around $3 million today), it hasn’t seen a single outgoing transaction.

The owner of the address was responsible for mining the very first Bitcoin block, so it’s likely that the wallet belonged to the cryptocurrency’s creator, Satoshi Nakamoto. It’s also possible that the owner of the wallet lost the corresponding private key, rendering the coins permanently inaccessible.

Types of cryptocurrency wallets

Needless to say, cryptocurrency wallets that are in use these days are far more advanced than the simple private key generator showcased above. Broadly speaking, though, you can condense most wallets into one of the following categories:

Software wallets

Software-based wallets represent the most widely-used kind of personal crypto wallets in recent years. These typically come in the form of a smartphone application or computer program. Getting started requires virtually no time. Download and install the wallet software on your device — that’s it!

The downside to using a software-based wallet is that your cryptocurrency holdings are only as secure as the underlying device. Sophisticated malware, for example, can scan for wallet-related files on your computer and drain your wallets in the background. And by the time you detect the intrusion, it may be too late.

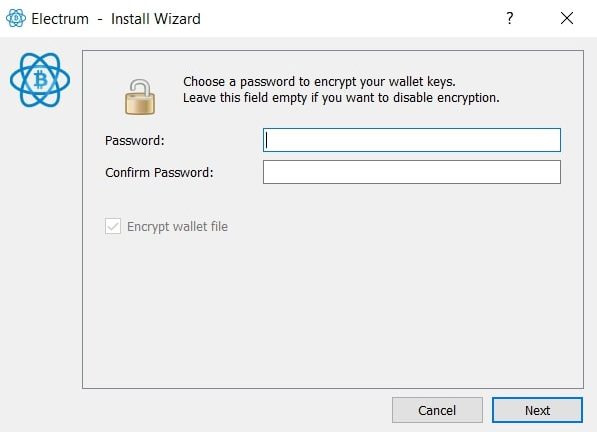

Most wallets offer to encrypt your private keys to mitigate this risk, but in many cases, don’t do it by default. The Electrum Bitcoin wallet, for example, offers the ability to enable password-based encryption during initial setup.

Hardware wallets

If you’re after the most secure kind of wallets with little to no caveats, consider hardware wallets.

Hardware wallets are dedicated electronic devices that store your private keys and related data in a secure storage environment. This means that no attacker can brute force their way into it, even if the wallet ends up in their possession. While secure, they do naturally involve a purchase. This higher bar for entry pushes people towards software-based alternatives.

USB sticks are the most common form factor for hardware wallets, which make them incredibly portable. Somewhat counterintuitively, however, these devices are best suited for long-term storage rather than everyday use. This is because a hardware wallet cannot operate unless it is connected to another external device, such as a smartphone or computer.

Hardware wallets are purposely basic and minimal ,so as to eliminate any potential security flaws or attack vectors.

Hardware wallets also do not directly connect to the internet to minimize the chances of hacks or vulnerabilities. The companies that sell them also have a reputation at stake so they tend to fix bugs faster than software wallet developers.

Still, with modern devices such as the Ledger Nano X boasting Bluetooth connectivity, hardware wallets these days are only slightly less convenient than software-only alternatives.

Online wallets

If you have ever purchased or traded cryptocurrency, chances are you’ve used an exchange such as Coinbase or Binance.

These platforms offer online crypto wallets with one key distinction — they don’t give you full control. Any cryptocurrency balance you hold on an exchange is just a number associated with your account. This is because exchanges consolidate their users’ funds in a handful of wallets, much like a bank. Binance, for example, holds over $10 billion worth of Bitcoin in a single wallet.

Unfortunately, exchanges don’t have the best track record when it comes to safe cryptocurrency storage in the long-term. While the big names such as Coinbase and Gemini are less likely to lose funds these days, there’s still a non-zero probability of it happening. And you can’t expect governments to bail out cryptocurrency exchanges. Unlike banks, most exchanges aren’t insured.

Consequently, online wallets are the least secure option because they require you to trust a third-party’s security practices. If you can accept the responsibility of using a software or hardware wallet, you should aim to offload your holdings from exchanges as soon as possible.

Read more: 10 best crypto wallets for Android

Which wallet should you use?

Regardless of whether you decide to go with a hardware or software-based wallet, there are hundreds of offerings on the market. This is because wallet choice is an extremely subjective opinion. Here are a few factors you should consider before selecting a particular wallet product or service:

User-friendliness and UI: Cryptocurrency wallets vary widely in terms of complexity and their feature sets. If you’re new to the ecosystem, don’t be afraid to pick a wallet that is lacking some advanced features. The most powerful and secure wallets are unfortunately also the most unintuitive for beginners.

Development philosophy: In the past, most software wallets were open-source creations developed by the enthusiast community at large. Open-source code is publicly viewable for anyone to audit or modify. These days, there are plenty of closed-source and proprietary options available as well. While there’s nothing wrong with proprietary wallets, do keep in mind that you’re essentially placing your trust in the developers of the wallet.

Community perception: Given the amount of money potentially at stake, it’s a good idea to check the reputation of any wallet before you download it. A simple Google search for reviews should tell you everything you need to know about the trustworthiness of a particular wallet.

Asset support: It goes without saying that the cryptocurrency wallet you choose should support the token you’re about to deposit. However, many wallets these days include support for dozens of assets simultaneously. Hardware wallets are the most flexible in this regard since they tend to include support for hundreds of tokens.

Back up your wallet!

Between 2009 and 2011, cryptocurrency wallets were not very intuitive or secure. This is best exemplified by the story of an anonymous forum user that lost access to 8,999 BTC (worth a staggering $350 million today) due to a technicality. Thanks to the transparent nature of blockchain, we can see that these coins are now permanently etched in the Bitcoin ledger. They haven’t moved since 2010.

Thankfully, wallet backups are not as complicated anymore, so you should prioritize creating one immediately.

Just about all modern software and hardware wallets these days will ask you to write down a list of 12 or 24 words. These words, also known as a seed phrase, offer an easy way to recover your wallet and its private keys.

If you ever lose access to the device containing your wallet, the seed phrase is all you need.

On the subject of good practices, make sure that you keep your wallet, seed phrase, and/or private keys in different places. Finally, create multiple copies and store them away from prying eyes. Many in the Bitcoin community swear by paper-based backups for their simplicity and resistance to cyber-attacks. Having said that, keep in mind that paper is also vulnerable to loss or destruction — so weigh these tradeoffs carefully.

Selecting the right cryptocurrency wallet for your needs may very well be the most important decision you make while starting out. Hopefully, this article has provided some insight into the inner workings of crypto wallets to help you make that decision. Either way, don’t be afraid to look around — software wallets are free to download, after all.

For further reading, check out our guide to buying cryptocurrency for information about exchanges, investing strategies, and taxation.

from Android Authority https://ift.tt/2UdO2ca